|

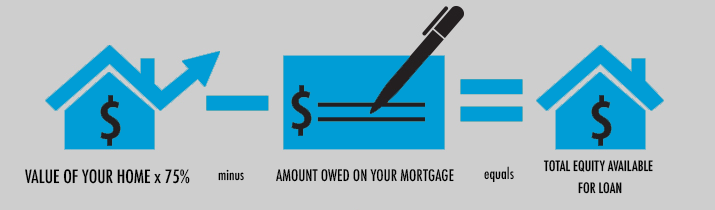

As the COVID-19 pandemic continues to affect various aspects of our lives, many homeowners in the Lower Mainland and on Vancouver Island are faced with countless challenges navigating through this uncertain time and keeping up with everyday expenses. Some homeowners in BC have had their home improvement projects and renovations placed on pause due to a reduced cash flow, while others are struggling with keeping up with credit card payments and managing other consumer debt. Whatever tricky situation you are in, it’s important to truly understand and evaluate your options in order to get your life back on track. If you are a current homeowner in British Columbia - whether that’s Vancouver, Burnaby, Surrey, Victoria, Kelowna, Abbotsford, or elsewhere in the Lower Mainland, you fortunately may be able to access your home equity to consolidate your debt or address a financial emergency you may be facing as a result of COVID-19. Home Equity LoansFor current homeowners looking to free up extra cash to consolidate their debt, continue a renovation on their property, or simply ease any financial burden you may be experiencing due to the COVID-19 pandemic, a home equity loan is an option worth considering to help you get back on your feet. A home equity loan is typically funded fairly quickly provided you have the available equity in your home. In most cases, you may be eligible to access up to 75% of your homes value for a home equity loan in BC with Silver Hill Mortgage Corp. A home equity loan can be used for almost anything, though they are often used to help finance the purchase of another property, or for unexpected expenses and emergency situations that arise. These home equity loans can be administered by the traditional banks, or by private mortgage brokers in BC who work with private mortgage lenders that may be able to help you access more favourable rates and find a solution unique to your situation. Even if you have been declined by a bank in the past, or have poor or bad credit, our team at Silver Hill Mortgage Corp. works with private mortgage lenders in the Lower Mainland to arrange a B-Lender mortgage solution to best fit your circumstances. If you’re in the midst of a financial emergency because of COVID-19, worried about foreclosure, looking to pursue debt consolidation, or simply need to access extra cash but have bad credit - a home equity loan may be able to help you in your situation. RefinancingLiving on Vancouver Island or in the Lower Mainland, and looking to replace your current mortgage loan with a new one? You might be able to qualify for a home equity loan that’s higher than your current loan balance. We work with you one-on-one to understand your personal financial and homeowner situation in order to help you evaluate your best options when looking to refinance. We base your loan approval on your available home equity, not your income or your credit like traditional banks. If you’re unsure of your available home equity and live in BC, use our home equity loan calculator or get in touch with us to discuss your options today with a free, no-obligation consultation. Contact Jim Horvath today at 604.620.2697 for a friendly conversation.

|

Silver Hill BlogJim Horvath is the principal broker and director of Silver Hill Mortgage Corp., arranging private mortgage loans in British Columbia for over 25 years. Archives

May 2024

Categories |

|

Silver Hill Mortgage Corp. Head Office

2902 West Broadway | Suite #302 Vancouver, BC, Canada V6K 2G8 E: info@yourequityloan.ca P: 604.620.2697 F: 855.299.5832 (Toll Free) |

Stay in Touch |

About UsSilver Hill Mortgage Corp. is a trusted industry leader in delivering home equity loans and other private mortgage financing solutions for homeowners and bank declined customers in British Columbia. Get in touch to get approved today.

Copyright © 2024 Silver Hill Mortgage Corp. All rights reserved. |

Proudly serving our BC communities:

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

RSS Feed

RSS Feed