|

Most of us have applied for credit at one time or another. There are 2 main credit bureau agencies in Canada - Equifax and TransUnion. They collect and administer your personal credit information in the form of a credit report, which can be requested by your lenders, employers, and landlords. Credit reports contain multiple pieces of personal and financial information, which are systematically organized and neatly presented into a report for easy review. What Information Is Collected About Me? Your credit bureau collects plenty of information related to you. The information related to you will include confidential details which are both personal and financial. The personal information in your credit report will include: * your legal name and all other know names you use or may have used previously * your date of birth * your social insurance number in some cases * your current and previous addresses * your current and previous employers * your credit score * any current or past accounts in collections for debt recovery * information which is of public record, such as foreclosure, bankruptcy, consumer proposal, tax liens and repossessions * a list of all credit inquiries made about you in the past 6 years, for all of the credit you have applied for previously The financial information in your credit report will include: * who your current & previous creditors are * the date you opened each credit account * the current outstanding balance of each active account and the minimum payment due for each, as applicable * the credit limit of each account * the details of each account – whether it is a personal loan, mortgage, car loan, credit card * the payment history of each account for a period of 6 years Where is My Information Collected From? All of the information contained in your credit report is provided by your creditors, financial institutions, other businesses, public records or third parties such as collection agencies. These parties report your account activities to a credit reporting agency periodically. This is information is kept in your personal credit file and is maintained for a period of 6 years. Every time you fill in an application for credit, some of the application information will recorded and noted in your credit bureau. This information would include a current address, length of time at current residence & employment details. Such information is offered up by the credit provider to the credit reporting companies in order to keep your personal information current. Your financial account details are also provided by your creditors. These include payment history, balances outstanding, credit type, and credit limits. It is good practise to review your own credit report each year to ensure it is accurate and there are no discrepancies. Who Will Need My Credit Report? You may be asked for a copy of your credit bureau for a number of reasons. The report will offer up extensive details about you and how you manage your credit and the responsibility associated with it. It provides a track record of your repayment habits and how you manage your financial obligations. It is an indicator of one’s character relating to credit worthiness & trust. Parties who would request to review a copy of your credit report would include: * Banks / Credit Unions * Credit Card providers * Insurance Companies * Employers * Auto Dealerships (car loans) * Landlords * Department Store Accounts A credit report will be required in almost all cases when applying for credit or services of a certain description. What if the information in my report is wrong? It is not uncommon to have errors in a credit report. There are so many bits of personal and financial information being updated and newly created periodically in a credit report all of the time. Due to all of the moving parts, there is a chance that some information may be inaccurate. Or even worst, what if your identity was compromised and your credit stolen and ruined? Never take your credit for granted and ensure you inspect your report at least once a year. You may request a free copy of your credit report through Equifax & TransUnion, and they will forward you a copy by mail. If you notice any irregularities or errors in your credit report, you must contact the creditor or lender. You may also dispute them by contacting the credit bureau agency. You will be required to outline the dispute, and the agency will investigate the situation and make any necessary changes. This process may take a long while in some cases such as stolen identity and fraud, as this type of investigation is conducted very thoroughly. You may also add notes and comments into your credit report, in an attempt to explain certain occurrences noted in your report. For example, if your report shows you had gone previously bankrupt, you may offer up an explanation as to why bankruptcy was the only option you had at that certain time in your life. The notes & comments offer up a story for the creditor to read and take into consideration for future reference. Where do I get a free copy of my credit report? You may obtain a free copy of your credit report in Canada through two main agencies who are Equifax & TransUnion. For a free copy of your credit report, you may contact either agency online or by: * phone * mail/fax * in person Their websites contain all of the information and direction you will need regarding any questions and to get that free credit report. TransUnion – www.transunion.ca Equifax – consumer.equifax.ca/personal/ You will be asked for some personal information from either agency, and they will prepare and send to you a copy of your credit report. It may take up to 10 days to receive the report in the mail. Requesting your own credit report does not reflect negatively in your report or in any manner. You may obtain a free copy of your credit report without any delay or issue. What does my Credit Score mean and how is it calculated?

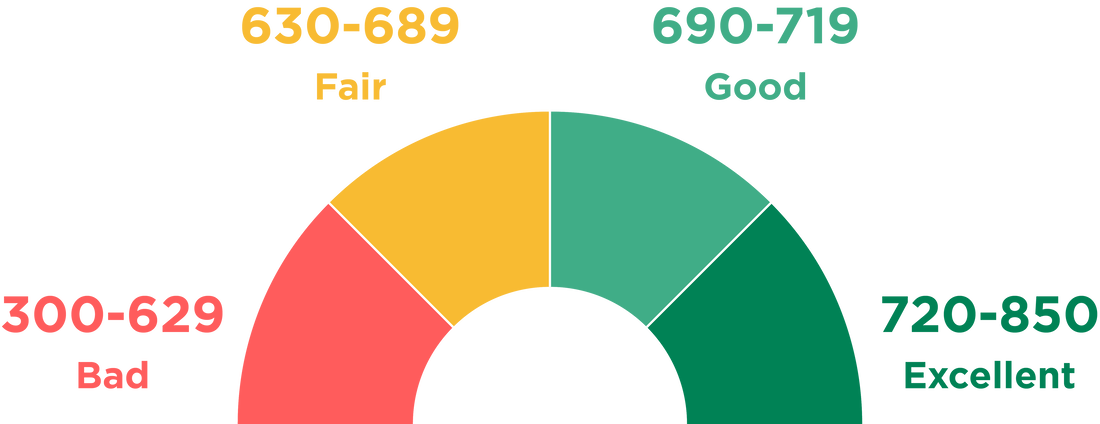

Your credit score is a grade of your credit worthiness, based on a numeric score range. Credit scores range from a low of 300 to a high score of 850. The higher your score, the better is your credit worthiness. The main factors which impact your credit score are: 1) Payment History – your payment track record is the most important item which will impact your credit rating. Approximately, 35% of your credit score is determined by your payment history. It is critical to make all payments on time and to void missing or being late with payments. 2) Use of Credit – your use of credit, by keeping current balances on your accounts will have a negative effect on your rating. Approximately, 30% of your score is affected by your credit utilization. It is best o keep your outstanding credit balances at a minimum or to pay in full when you can. 3) Length of Credit History – the length of time you have had an active credit account will also impact your credit score. Approximately, 15% of your score is affected by the active life span of each creditor account of yours. 4) New Credit & Number of Inquires – Approximately, 10% of your score is affected by you opening a new account and having new inquiry registered on your report as a result. The more inquiries reported in your credit report may result in a lower credit score. 5) Type of Credit – the type of credit will also impact your credit score – Approximately, 10% of your score is determined by the types of credit accounts you keep. The various accounts may include credit cards, car loans/leases, mortgage, lines of credit, etc. The more various types of credit you can manage well, will reflect positively and help raise your credit score. It is important to learn how to read your credit report so you can understand the mechanics, spot any issues and ensure the information is accurate. It is recommended that you request a copy of your personal credit report and review it in detail at least once a year. Stay tuned for more updates on the blog. For more information, or if you have any questions, reach out to Jim at [email protected] |

Silver Hill BlogJim Horvath is the principal broker and director of Silver Hill Mortgage Corp., arranging private mortgage loans in British Columbia for over 25 years. Archives

May 2024

Categories |

|

Silver Hill Mortgage Corp. Head Office

2902 West Broadway | Suite #302 Vancouver, BC, Canada V6K 2G8 E: info@yourequityloan.ca P: 604.620.2697 F: 855.299.5832 (Toll Free) |

Stay in Touch |

About UsSilver Hill Mortgage Corp. is a trusted industry leader in delivering home equity loans and other private mortgage financing solutions for homeowners and bank declined customers in British Columbia. Get in touch to get approved today.

Copyright © 2024 Silver Hill Mortgage Corp. All rights reserved. |

Proudly serving our BC communities:

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

RSS Feed

RSS Feed