|

If you are currently looking for mortgage financing and live in Vancouver or elsewhere in British Columbia, you will learn very quickly that are so many lenders and sources of mortgage funds out there. There are numerous mortgage options for any and all types of mortgage requests, whether you live in the Metro Vancouver area, on Vancouver Island, or in the Okanagan. Funds for mortgages are available from the major banks to individual private lenders. The competition for mortgage business is great, especially in today’s market, allowing customers to benefit from the many options and competition for their valued business. Because of this, a borrower should do their research before deciding on a mortgage lender to move forward with. Another option would be to take on the services of a mortgage broker, who will effectively maneuver you through the mortgage market maze. A mortgage broker will save you a lot of time and explain in detail the various mortgage products and options available depending on your situation. Brokers can “cut to the chase”, as they specialize in mortgages. After an initial consultation, they are able to pinpoint and narrow down the best finance options quickly and effectively for customers.

Here is a list of the various sources of mortgages available for residential or Commercial purposes that one may wish to consider: 1) Commercial Banks: The primary commercial banks in Canada are:

Commercial Banks typically offer the lowest interest rates, along with special mortgage products and benefits to customers. Commercial banks are usually on top of the list when it comes to the best interest rate discounts and specials. However, their lending standards are strict and the turnaround for getting a loan is far longer than most lenders. 2) Trust Companies: Trust companies are generally the next step down from commercial banks. They are an alternative lender, whose mortgage rates are marginally higher than banks, and their loan guidelines are more flexible. Further, they may charge a small fee for arranging the loan called a lender fee. This lender fee is usually .50 – 1% of the gross loan. This fee is charged in addition to interest rate. 3) Credit Unions: Another option to getting cost effective mortgage financing is through a credit union. Credit unions offer a full range of bank services. They cover off everything from loans of all descriptions to various types of accounts such as saving, checking, etc. Their interest rates compare with bank rates in most cases. Credit unions are non-profit, so they often have lower fees than traditional banks. Credit unions are community oriented, offering fast and personalized services to their customers. 4) Mortgage Investment Companies: Mortgage investment companies are non-bank lenders who provide creative financing solutions. They mainly cater to customers who have poor or damaged credit, and little or no income to show. They take on riskier loans and are primarily an equity lender. They put a bulk of the weight for approval on the type of real estate and the amount of equity available to lend on. Their rates are much higher that banks, credit unions & trust companies. They are a flexible lender with far fewer lending guidelines, but all at a higher cost than most market lenders. They also charge a lender fee for their services. Lender fees can start as low as .50% of the gross loan and go up from there. 5) Private Lenders: Private mortgage lenders are individual people who lend their own funds for mortgage financing. Private lenders are private individuals who could be a friend, family member, acquaintance, etc. Private mortgage lenders are usually very flexible and determine their own lending guidelines. They are great to work with one on one, as they call their own shots, since it is their money. Their interest rates are higher than most lenders, and they may charge a fee for the loan in addition to. Turnaround for approval and funding with a private lender can be quick. This is because they have far fewer guidelines, and the buck stops with them. 6) Vendor Take-Back mortgage (VTB): A vendor loan is when the seller of a property extends a loan to buyer to help secure the sale of the property. This happens when the buyer does not have enough resources to close on the sale of a property. If down payment & the approved 1st mortgage of the buyer is not enough to cover the price of a piece of property, there will be a shortfall. The seller may carry back a loan in the amount of the shortfall, so the buyer can close on the sale. This will ensure that there are enough funds to complete on the sale. The vendor loan in this case would be a 2nd mortgage secured against the property, right behind the 1st mortgage. The vendor loan would be registered in favour of the seller, yielding interest to the lenders benefit. The details of the vendor loan are usually negotiated directly between the seller and purchaser. 7) Assuming an existing mortgage: Another option to getting a mortgage when purchasing a property, is to assume the existing mortgage on that property. You may legally take over a mortgage by assuming the original loan. In order to do this, you must meet the lenders requirements. That is that you would have to fully qualify under the lender’s guidelines. Further, you would have to carry on with the existing rate and loan provisions if you assume the loan. If this is an option you might be considering, you must ensure the loan is assumable, and get proper legal advice as to your legal obligations under the original loan. 8) Reverse Mortgage: A reverse mortgage may be an ideal loan option for seniors who have plenty of equity in their home. The equity in the home may be used to get a loan called a “reverse mortgage”. Unlike regular mortgages, there is no repayment required from the borrower until they pass away, or the home is sold. This allows the borrower access to funds without having regular monthly mortgage payments. The borrower can decide if they want the loan in one lump sum, or disbursed in set up intervals. It allows folks to hold on to the ownership of their home and have funds available for their day to day. The costs associated with reverse mortgages is often higher than most other alternatives, but it offers definite advantages to the elderly, who would not typically qualify for a bank loan. As you can see, there are many options to pursue for mortgage financing. It would be strongly advised that one should seek out the services of a mortgage broker to better understand the options best suited for a borrower. If you’re a current homeowner looking to explore your mortgage options, get in touch with us for a free quote today: 604.620.2697. Struggling to keep up with bills and financing your lifestyle? Then you’ll want to know more about second mortgages. A good place to start is to learn about the myths about getting a second mortgage. Like most financial options, there are some myths surrounding second mortgages that often arise when homeowners explore this option. We have debunked those myths for your convenience - let’s take a look!

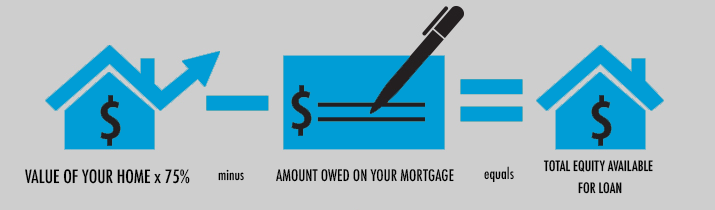

1. Second Mortgages Are Only For People That Are Out of Options The first myth to debunk is the notion that second mortgages are only for people that are out of options. This is a pure myth because, in order to qualify for a second mortgage, you have to own a home that has enough equity available to borrow against. Most people that are running out of financial options don’t own a home. You should be proud of the fact that you own a home and have enough equity to borrow against. Even if you're not in a tricky situation, and looking to simply tap into your home equity to finance a new home renovation, or to help with the purchase of a new home, a second mortgage can help with just that! 2. Second Mortgages Are Complicated One of the most common myths about second mortgages is the claim that they are extremely complicated. This is not true. In concept, a second mortgage is extremely simple. If you own a home and you have a substantial amount of equity available, you can convert that equity into cash. You can choose to receive the money from your second mortgage in a lump sum or in monthly payments, depending on your lender. In any case, trusted professionals like the team at Silver Hill Mortgage can walk you through the process and answer any questions that you might have. Not sure how much equity you have? Take a look at our Home Equity Loan Calculator to get an estimate! 3. You Can Only Use the Money From a Second Mortgage for Certain Things Perhaps one of the most misleading myths about second mortgages of all is when folks claim that you can only use the money from a second mortgage for certain things. You should know that there are no restrictions whatsoever as to how you can spend the money that you receive from a second mortgage. It’s your home equity - which means you can use the money for anything you wish, whether it be for debt consolidation, new home renovations, business capital, or even medical emergencies. If you are purchasing or refinancing, a second mortgage can help with providing the funding you need for that as well. Get Your Second Mortgage From Silver Hill Mortgage, No Tricks, No Myths, Just a Great Deal! Now that you know more about the myths about second mortgages, you’re ready to take advantage of this unique financial option. Silver Hill Mortgage specializes in helping families across Vancouver, Kelowna, Victoria, and the Lower Mainland take advantage of second mortgages and tap into their home equity. Want to turn your equity into cash? Then give Silver Hill Mortgage a call, we’re ready to help! Talk to Jim today at 604.620.2697. Having a hard time paying the bills? You’re not alone - the COVID-19 pandemic has put millions of people out of work unexpectedly, and has created financial hardships that many can resonate with. With changes in restrictions happening every so often, the uncertainty surrounding business operations and job security is nothing new. You worked hard to get where you are today and become a homeowner, whether that be in Vancouver or elsewhere in the Lower Mainland. With the ongoing pandemic thrown in and bills piling up, it may sometimes seem like a daunting task of staying afloat and keeping things in check. What do you do when you’re struggling to keep up with the bills and almost out of options? Here’s what you need to know about second mortgages and how they can help you find a way out. What is a Second Mortgage? First thing’s first, what is a second mortgage anyway? A second mortgage, also known as a home equity loan is a special kind of financing option for homeowners in Vancouver. When you take out a loan, there’s usually some kind of collateral that’s put up to secure the loan. Sounds familiar right? Well, when you take out a second mortgage, you’re essentially borrowing the money you need at this time against the value of your property. Essentially, you’ll be using your property as collateral to secure the loan - that’s how a second mortgage works. What Can You Use the Money From a Second Mortgage For? Some loans are very particular about what you can actually use the money that you’re borrowing for. When you take out a second mortgage from Silver Hill Mortgage, you have a tremendous amount of freedom in terms of how you can use the money. Common reasons for folks taking out a second mortgage include things like paying unexpected bills that may come up, financing a large family expense, or paying for your children’s education. Life happens, and when it does, Silver Hill Mortgage is there to support by helping you access the money you need to get through these challenges with a home equity loan. For example, medical problems can occur at any point in time which is what makes the resulting expenses so unexpected. While you’ve been saving away for your son or daughter’s education fund, you may have had a loved one fall ill which requires costly medical care. Sometimes you might not have the funds to address unexpected bills, in which case you can take out a second mortgage to help put yourself back on track financially. Alternatively, many people use money from home equity loans to make improvements to their home and finance renovations. Folks with growing families who don’t want to move right away can use the money from a second mortgage to renovate their home to suit their needs.  How Does a Second Mortgage Work? Now that you know more about the basic principles of second mortgages and what you can use the money from them for, let’s take a closer look at how they work. Everyone will have a different scenario, but the principles remain the same. That is to say, if you bought a home, you may be able to access up to 75% of its value, less the amount owing on your mortgage, in the form of a home equity loan, or second mortgage. What does that mean for you? Check out our Home Equity Calculator to get an idea of your available equity. Unlike factors like income, the amount that you can qualify for under a second mortgage ultimately depends on how much equity you have to borrow against. To learn more about borrowing using your home equity, click here. The Advantages of Taking Out a Second Mortgage Second mortgages have many key advantages to offer, and if you use the money that you borrow wisely, you can end up doing better than ever. For one thing, the fact that there are no limits as to what you can use the money for is a huge advantage. It’s your equity which means you can use it any way that you want. If you want to use that equity to finance a college or university education for your children, then by all means, do it. Likewise, if you want to use that hard-earned equity to buy yourself a new car for the family, you can do that too. That’s the kind of freedom that a home equity loan from Silver Hill Mortgage can help you achieve. The list of advantages doesn’t stop there, second mortgages also tout lower interest rates than credit cards. One of the most common mistakes people make when they need cash fast is to charge everything to their credit cards until they’re all maxed out. When you max out all of your credit cards to conquer an unexpected expense like a medical emergency, you’ll be paying through the roof in interest on those cards. If you had gotten a second mortgage instead, you’d have a much lower interest rate on the loan than you’d find with any credit card. Another advantage of second mortgages is the fact that you can typically borrow up to 75-80% of your equity. If you added up the total credit limit between all of your credit cards, you might be able to get a few thousand dollars. With a second mortgage - you can qualify for much larger amounts. It is important to note that the experience you’ll have taking out a second mortgage largely depends on who you work with. Have a question about second mortgages and live in the Lower Mainland? Get in touch with us and we’d be happy to chat. Find the Silver Lining with Silver Hill Mortgage Ready to take charge of your financial future? Then you’re ready to have a chat with us at Silver Hill Mortgage. We understand what it’s like to fall upon hard times, and that’s why we have such a strong reputation for helping people through similar situations. If you think a second mortgage might be right for you, give Jim a call at 604.620.2697 to answer any questions you might have about getting started. There are many reasons to purchase a second property, however, many folks find it difficult to finance. That doesn’t mean it’s impossible, it doesn’t even have to be that hard. Bridge financing is a special finance option that can help you finance the purchase of a second home with ease, whether you’re in Vancouver, Surrey, Langley, or elsewhere in the Lower Mainland. Here’s what you need to know about bridge financing and how it can help you buy a second property.

What is Bridge Financing? A bridge loan is a short-term mortgage that can be used to literally bridge the gap between an old mortgage and a new one. For example, say you live in Vancouver currently. With the COVID-19 pandemic going on and many continuing to work from home, you decide to move to the interior of BC as you no longer need to be in the city. Say your current Vancouver home is for sale, and you want to buy a new one in Kelowna before your house sells. Most people wouldn’t be able to take on another mortgage before selling their original home. That’s where bridge financing comes in. When you take out a bridge loan, you’re essentially taking out a short-term mortgage to finance the purchase of a second home. By the time your original house sells and you settle up on your old mortgage, you’re free to focus on the loan for your new home. How Does it Work Bridge loans are financed against the equity of your current home. This makes them relatively easy to qualify for. All you need to do is use the equity of your current home to back the financing for your second home. It’s easy, especially when your bridge loan is with Silver Hill Mortgage! The process itself is refreshingly straightforward, and you won’t be stuck waiting for months from a bank. Bridge loans give people the freedom to purchase additional properties without the hassle of a bank loan. What are the Advantages of Bridge Financing? Bridge loans have a lot of advantages, especially for individuals and families that are trying to swing the purchase of a second home in BC. One of the most compelling advantages of bridge financing is the expediency it affords. Without a bridge loan, you’d have to put all of your possessions in storage until your house sells and you qualify for a new mortgage with a bank to purchase your next home. When you take out a bridge loan, you won’t have to put anything in storage or wait around in limbo - you’ll be free to move into a new home of your choice. Another key advantage is the fact that bridge financing is extremely accessible because you can use the equity of your current property as collateral. Finally, bridge loans offer security and flexibility. If you try taking on a new mortgage for a second home when you already owe $250,000 on your current property, your odds of qualifying for another $250,000+ for that second home are pretty slim when you work with a bank. Bridge financing makes it possible to get the second home of your dreams without having to make any compromises. Silver Hill Mortgage Corp. If you’re looking to buy a second home and you’re worried about how to finance it, Silver Hill Mortgage is here to help. We understand the challenges of buying a second property, we also know how to help people overcome those challenges and achieve their goals. Have a question or want to discuss your options further? Give Jim a call for a friendly chat at 604.620.2697. With portions of the economy severely slumping and job uncertainty looming as the COVID-19 pandemic continues, it may be tough for some to maintain their monthly financial obligations. Imagine if you could no longer pay your rent or mortgage payment, for whatever reason. The uncertainty of what to do may be very crippling and overwhelming for anyone, whether you live in the city like Vancouver, or out elsewhere in the Lower Mainland. Simply maintain the terms of the mortgage and payments as agreed with the lender, and you will remain problem free. However, if the terms are not met and payments are missed, the lender may exercise a number of actions against you to save their security. A number of factors may trigger a default of your mortgage. These include:

What are my options? There are several options for borrowers when in default. If a borrower is having difficulty maintain their mortgage payments, there are many options to consider, depending on your situation. These include:

It is best to always remain connected with the lender and reassure them that you are trying work out a solution. You want to avoid getting into a situation where you may be headed towards foreclosure. Mortgage foreclosure is costly and the last thing any lender wants to do is re-possess the property or force a sale through foreclosure. Lenders Options When in Default:

If a borrower has exhausted all of the possible options and still unable to stop default, the lender has options they can exercise and help remedy the situation. The lender will try and work with the borrower to remedy the default, but if all fails, the lender may:

If ever you are in a vulnerable financial situation and may default on a loan payment, the best advice is to contact the lender. Reach out to the lender well in advance of the payment due date and notify them. Let them know that you are going through rough waters, and that you want to make things work and ultimately find a solution. The worst thing to do is to remain silent and ignore the lender and your responsibility. Also, you may contact a mortgage broker, who will outline the options available to you. Needing help with your mortgage or have questions about your options? Give us a friendly call today at (604) 620 2697 and we’d be happy to help out! For those in BC who are actively looking to purchase property, whether it be for personal use or as an investment, it is more than likely that you will need a mortgage to do so. Unless you have the means to pay for the property in full, you will need to borrow a portion of the funds when you decide to purchase. Prior to this important decision, there are several key factors you must consider to ensure that the mortgage is right for you. Since you are taking upon yourself the single largest financial obligation in your life, you want to be certain that the loan you decide to take on meets your needs.

We’ve whipped up a list of terms you to keep an eye out for to take into consideration when entering into a mortgage agreement: Interest Rate & Compounding Period: Most consumers look to the interest rate as the determining factor when making their decision on a mortgage. It seems to register as the one single cost and obsession associated with borrowing money, and this pretty much makes up most people’s minds. The interest rate is extremely important, but as you will see it is not the only cost of the loan, and there are other important considerations. Mortgage interest rates are calculated as either a fixed or variable interest rate. A fixed interest rate will do just that, it will remain constant for the term of your loan. In other words, your interest rate will stay the same each month, as will your mortgage payment. The variable rate means that the interest rate may change each month, as the rate is variable or as referred to as a floating rate. Any potential variable rate movement may be caused by the lender adjusting their prime lending rate. Rate changes by the Bank of Canada or changes in economic conditions may set off variable interest rate changes. Even though your monthly mortgage payment would stay the same with a variable rate mortgage, the amount allocated towards principle and interest of the payment, may be adjusted. If the variable rate goes down, you are paying off more principle and less interest with each payment, and vice versa. The second item you want to know about the interest rate, is the compounding period. In other words, the interest charged on the interest owing, will determine the total amount of interest that you pay on your mortgage. The more frequent the compounding period, the more interest you will pay. It is important to verify the compounding period of your mortgage, as this can potentially save you thousands. Length of Mortgage: The length of the mortgage usually refers to the term, or length of time the lender will lend you the funds. The term of a mortgage may range from 6 months to 10 years and beyond. At the end of each term, the unpaid balance of the mortgage and interest become due and payable. Typically, the lender will send a renewal notice to the borrower at the end of the mortgage term. The renewal period will allow you the opportunity to renegotiate another term with the current lender, or the option to go and search out a new competitive lender with more favourable terms. The term of the mortgage should also be an important consideration. You must determine how long you are willing to commit to an agreement with the lender, all things considered. Amortization Period: Amortization is the length of time over which the mortgage payments are calculated & spread, based on the assumption that the mortgage will be fully paid over that period. Most mortgages are amortized over a 25-year period, but this can vary. In some cases, you may request an amortization which works best with your budget. You may insist on paying the mortgage down quickly and so want a short amortization, or you might want to keep your payments to a minimum and so a longer amortization will work best. Not every lender is amortization flexible, so you should certainly ask the lender about their options regarding the amortization of their loans. Open or Closed Terms: Open mortgages allow for plenty of flexibility to the borrower. It allows you to pay off or pay down the mortgage without any limit, penalties or extra costs. Also, you may up the monthly payment at any time and pay the loan down faster as you wish. A closed mortgage locks you into the term for a fixed period of time. You may not pay the loan off or down as you wish, without being subject to a potential interest penalty. The costs to pay out a closed mortgage can be extremely expensive. Some lenders will charge the greater of a 3-month interest penalty or an interest differential investment rate, as a prepayment penalty of a mortgage. In some cases, the lenders will not allow payout of the mortgage unless the house is sold. It is super important to learn the costs associated with the closed terms of the loan with the specific lender. Payment Frequency: The mortgage payment frequency schedule has many options available. Lenders will offer weekly, bi-weekly, and monthly payment options. As you know, the more frequently you make mortgage payments, the lower the amount of interest that you will be paying and the faster you will pay off your loan. You will need to make for certain which payment frequency works best with your pay schedule and lifestyle. This is because it is not possible to switch up payment frequencies in the middle of the loan term. Therefore, make for certain you are comfortable with the loan payment frequency. Pre-Payment Privileges: The prepayment privilege you must investigate if you have decided to take a closed mortgage term. An open mortgage is not bound to any limitations and may be paid down or out without any penalty, anytime. With closed mortgages, your hands are somewhat tied when it comes to prepaying the loan. Closed mortgages permit prepayment in a certain manner and at certain stages of the loan. As a result, you may be permitted to prepay the loan by a preset percentage of the total loan each year. In other words, the lender may only allow the loan to be paid down by a maximum of 10-20% annually. Additionally, the mortgage payment may only be increased by a set percent each year as well. As you can see, there are limits set out by the lender reducing the loan flexibility, unlike the open mortgage. One can understand the unbelievable difference this would make in terms of saving on interest and reducing the amortization period. Every time a prepayment is made, or every time you increase your monthly payments, the balance outstanding and the monthly cost of interest is reduced. Prepayment options should be seriously looked into as it can save you thousands. Assumability: Assumability references that the buyer of your property will take over the obligations of the mortgage you are currently in. Not all mortgages are assumable, and each mortgage contract will specify an option for a potential buyer to assume. Most lenders would prefer to be paid out in the event that a property is sold, but many lenders do have clauses in their loans, indicating that the mortgage is assumable upon qualification. Portability: Mortgage portability is a feature that if you sell one property and purchase another while you are in the middle of your mortgage term, you can transfer the mortgage to the new property. You may consider this when you have a low interest rate and wish to maintain it, as you move on to a new property. Also, if the loan and terms you currently have are pleasing and advantageous to your situation, you would want to port to the new property. Again, the portability feature is dependent on the new property qualifying to the standards of the lender. Closing Costs: Closing costs are the fees associated with getting a mortgage. In most cases, the cost of getting a mortgage through a bank will include lawyer costs, appraisal fee & taxes. These are pretty standard for any bank mortgage. You will be responsible for the cost of paying a lawyer to review the terms of the loan, and the cost of getting the property appraised. However, if you need a personal loan or mortgages services from B-Lenders or private mortgage lenders in BC, there may be additional costs such as a lender fee and mortgage broker fee. Additionally, you would be responsible for the private mortgage lenders’ legal fees. The costs associated with B-Lenders & private hard money lenders may become extraordinary. It is best to obtain the services of a mortgage specialist, so they can discuss your information and determine how you can benefit from the numerous mortgage options available to you, leveraging the many lenders in the marketplace. Whether you are looking for hard money lenders in BC, bridge loans, a home equity loan, or simple advice to weigh out your options, give us a call today and we’d be happy to engage in a friendly conversation. There’s nothing more discouraging than being declined for financing by a bank, especially when you have people counting on you at home. We’ve all been there, one minute you’ve got everything under control, next minute you’ve got a pile of overdue bills and a steep mortgage payment with no solution in sight. If you’re in this situation, don’t panic, there is a solution, it’s called B-Lending. Here’s what you need to know about the benefits of B-Lending and how it can help you climb out of a very dark hole with your pride intact.

B-Lending 101 When you’re stressed out and you've just been declined by a bank, you might find yourself willing to try anything to fix the problem. At this point some people start making bad decisions like seeking money from a short-term lend or applying for a payday loan. These types of loans can be ruinous and most of them are designed to make things even worse. The risk, like the interest rate, is exceptionally high. B-Lending on the other hand, is comparatively less risky and more advantageous. It’s the perfect balance between the bank loans that you can’t get and the short-term loans that you shouldn’t get. B-Lending refers to subprime loans which are loans that you can qualify for even if you have bad credit. This is your way out, B-Lending can give you the big break that you’ve been looking for and help you take control of your life. Mortgage Lending Vs. Borrowing From a Bank People living in Greater Vancouver and the Lower Mainland that need access to funds for any reason from financing renovations, a large or unexpected expense, purchasing a second property, consolidating debt, for emergency purposes, etc. can benefit from private mortgage lending. Compared to a financier that offers private mortgage and home equity loans, banks are much more strict. A bank’s qualification requirements are comparatively much more rigorous and people who are already struggling financially are typically denied access to additional funding. Overall, there are some pretty spectacular advantages to private mortgage lending, especially for borrowers that are self-employed, have bad credit, or both. Let’s take a look at some of the most popular and advantageous finance options that mortgage lending makes possible for the people that banks have unceremoniously turned away. The Advantages of Home Equity Loans When you can’t make the payments on multiple debts and the walls are closing in, a home equity loan can be your new best friend. These loans can be used to free up cash that’s tied up in the value of your home. That’s cash that you can use to dig your way out, not to mention, you’ll get a substantially better interest rate! For example, say you’re self-employed with an auto loan and a few credit cards. Due to a family emergency you run up the balance on your credit cards until you’re overextended, then business slows down, you’re not taking as much money in as usual and the bank is itching to take both your home and your vehicle away from you in one fell swoop. Now you’ve got a right financial mess with multiple payments and no money to pay them. What do you do? The smart thing to do in this situation is to apply for a home equity loan from Silver Hill Mortgage. A home equity loan works like this - you borrow money against the value of your property and use it to consolidate all of your outstanding debts into one neat little loan with a better interest rate. You’ll have one loan, one payment, and a lower interest rate, it’s that simple! How Second Mortgage Loans Can Save Your Skin For folks who've got their backs pressed up against the wall and are struggling to keep up with the high payments on their mortgage and other debts, a second mortgage just might be the solution you’ve been looking for. A second mortgage is kept separate from your original mortgage as an independent loan. You can leverage a second mortgage to access up to 75% of the value of your home. People who are struggling to keep up with their mortgage payment and are facing the brink of foreclosure can solve all of their problems at once with a second mortgage from Silver Hill Mortgage. Taking out a second mortgage can help you avoid defaulting on your original mortgage and subsequently skirt the blood-curdling penalty fee. If you’re self-employed, odds are you’ve had trouble getting approved for any additional financing from a bank. They tend to be rather stingy that way. Mortgage lenders like Silver Hill Mortgage aren’t so stingy, we value your business and we work with people that are self-employed or have bad credit. Welcome to Silver Hill Mortgage, Where Your Financial Needs Are Met Silver Hill Mortgage Corp. provides private and institutional mortgages for distressed homeowners who have been declined by a bank. These loans can be issued for virtually any purpose, circumstance, or property type. Silver Hill Mortgage works with customers all across the beautiful province of British Columbia (from Victoria and Nanaimo, to Kelowna, Abbotsford, and the rest of interior BC) and specializes in private mortgage financing solutions. Unlike banks we don’t pressure our customers, we have the knowledge and integrity to serve you better and help you achieve your financial goals. The bank didn’t want your business, but we do, and we’ll earn it! If you’re running out of options and need to get your hands on some capital on the quick, get in touch with us at Silver Hill Mortgage. Life is too short to succumb to the stresses of finance - we’re here to help. Tired of getting rejection letters from the bank and staring at piles of overdue bills? It’s time to call Jim at 604.620.2697 - help is just a phone call away! With the ongoing COVID-19 crisis, many Canadians have been greatly impacted by the financial stresses it has caused. As you know, many jobs have been lost and, in some cases, businesses have been completely erased. Financial setbacks and ruin are so common and such a reality each day, and sometimes banks and financial institutions only have so much wiggle room to assist. If you try and get their help, it is a pressing uphill battle to meet their requirements. The loan qualification process through a bank is tough enough on the best of days, but with COVID-19 compounding problems, one can only imagine how much more difficult the process has become. As a result, in many cases they might not be able to help as quickly as needed. Homeowners in the Lower Mainland presently are finding it extremely challenging trying to get mortgage financing through banks and other various institutions. Trying to refinance your existing mortgage or getting a new mortgage altogether seems almost impossible. The banks have tightened the rules and use overkill scrutiny with each loan application. Any little blemish on your credit report can spell certain rejection. Your Income amount, type of employment and time at your job will also greatly impact your chances of getting the loan. With the unemployment numbers rising, lenders are getting extremely concerned about repayment ability. As you can see, sadly the current situation is a mess for all parties involved. There are options out there for homeowners needing help but cannot qualify for bank mortgage. Various B lenders and private sources are available. Many of these lenders are open for business and have flexible mortgage terms. They are ready, willing to engage and help with most home equity loan requests. They are easy to deal with and very receptive to connect and build a relationship with the client. These lenders use a make sense approach with each mortgage request. They are equity lenders for the most part - so they allocate more value and merit in your available home equity, unlike the banks. They place far more of their mortgage approval decision on your available equity. Income and perhaps credit will factor in on a far smaller scale, but they are necessary components to help with the lenders mortgage approval.

Here are some of the benefits in considering alternative mortgage financing, such as home equity loans funded by private mortgage firms and investors. Easy to Qualify – So easy. In most cases, your available property equity will dictate the terms of the loan. If you have equity, the private lender can help. The basic requirements are a completed application form, appraisal report of the property, title inspection, credit bureau review and a comfort level with the borrower’s ability to repay. Flexibility – The private lender will review the application personally and can tailor the loan to the specifications for the borrower or their situation. The lender will work with the borrower to try and best satisfy the loan request. They lend on all property types regardless of location. – They will lend on houses, condos, farms, raw land, commercial properties, recreational properties, leasehold properties, remiated marijuana grow-operations, bridge loans… just about anything. They finance those with credit and income issues – bad credit or no credit, little to no income, a mortgage loan solution is still an option. They finance all loan request types; construction loans, partial interest ownership, education /medical expenses, debt consolidation, renovations, anything important to you. Quick Fundings – They have the ability to fund loans in a short period of time without hesitation. They can adjust the timeline to processing the mortgage loan request and ultimately getting funds. They have the ability to control the entire loan process from start to finish, Emergency help – they are able to act quickly in times of despair. If you are experiencing difficulties pursuing a home equity loan during this pandemic and need help or some direction, you should contact a mortgage broker. The mortgage broker will review your situation, lay out the potential options and secure you the help you need. To have a friendly phone call today to discuss your situation and see your options, get in touch with Jim at 604-620-2697. Thinking of buying a rental property? Congratulations on discovering the best way for smart investors to secure and grow their money. Rental properties represent an avenue to invest in a long-term asset, allowing you to generate monthly income. It has many advantages over stocks, gold, commodities, and cryptocurrencies. It is tangible and resilient against a lot of the shocks that stocks and mutual funds are vulnerable to. At the same time, however, investing in real estate is not a walk in the park. There are potential pitfalls that first-time property investors need to be aware of if they are to make the most of their investments. And one of the most challenging areas for would-be real estate investors is financing. Getting a mortgage for a primary residence is very different from a mortgage for a rental property. Today we will dive into helping you understand the key things you need to know when applying for an investment property loan.  Do you qualify? What do traditional lenders look at before they decide to approve or to decline a loan application? They look at a combination of the person's financial capacity and their money management abilities. The factors they may consider include:

Financing Options Along with conventional mortgage loans, investors have other options for financing the purchase of their second property:

Types of Investment Properties

In addition to the qualification criteria listed above, the type of investment property an investor is planning to purchase is essential as it determines what their financing will look like. There are two types of investment properties:

Down payment Since 2010, the down payment required for investing in a rental property in Canada is 20%. For owner-occupied properties with 3-4 living units, the accepted down payment may be as low as 10%. If the home has only two units, the down-payment for owner-occupied homes goes down to 5%. But if a property is non-owner-occupied, regardless of whether it has 2 or 4 units, the down-payment is 20%. Additionally, non-owner-occupied homes have a maximum loan-to-value (LTV) ratio of 80%, versus 90%-95% for owner-occupied properties. Amortization periods Investors who make a down payment of less than 20% can expect an amortization period of 25 years. But if they down put 25% of the property value or more, they qualify for an amortization period of 30-35 years. This is regardless of whether the property is owner-occupied or not. More extended amortization periods mean lower monthly payments, but more interest is paid over the loan's lifetime. But a more extended amortization period is a plus for rental property owners because interest payments are tax-deductible, and it lowers the monthly carrying costs on the property. Finally, one of the best things you can do for yourself, as a first-time rental property investor, is to find a mortgage broker who has experience with investment properties. An experienced broker will help you navigate the inroads of investment property financing and ensure you get the best rates available in the market. To learn more about how to leverage your home equity to buy a rental property, have a friendly call with Jim today at 604.620.2697. As the COVID-19 pandemic continues to affect various aspects of our lives, many homeowners in the Lower Mainland and on Vancouver Island are faced with countless challenges navigating through this uncertain time and keeping up with everyday expenses. Some homeowners in BC have had their home improvement projects and renovations placed on pause due to a reduced cash flow, while others are struggling with keeping up with credit card payments and managing other consumer debt. Whatever tricky situation you are in, it’s important to truly understand and evaluate your options in order to get your life back on track. If you are a current homeowner in British Columbia - whether that’s Vancouver, Burnaby, Surrey, Victoria, Kelowna, Abbotsford, or elsewhere in the Lower Mainland, you fortunately may be able to access your home equity to consolidate your debt or address a financial emergency you may be facing as a result of COVID-19. Home Equity LoansFor current homeowners looking to free up extra cash to consolidate their debt, continue a renovation on their property, or simply ease any financial burden you may be experiencing due to the COVID-19 pandemic, a home equity loan is an option worth considering to help you get back on your feet. A home equity loan is typically funded fairly quickly provided you have the available equity in your home. In most cases, you may be eligible to access up to 75% of your homes value for a home equity loan in BC with Silver Hill Mortgage Corp. A home equity loan can be used for almost anything, though they are often used to help finance the purchase of another property, or for unexpected expenses and emergency situations that arise. These home equity loans can be administered by the traditional banks, or by private mortgage brokers in BC who work with private mortgage lenders that may be able to help you access more favourable rates and find a solution unique to your situation. Even if you have been declined by a bank in the past, or have poor or bad credit, our team at Silver Hill Mortgage Corp. works with private mortgage lenders in the Lower Mainland to arrange a B-Lender mortgage solution to best fit your circumstances. If you’re in the midst of a financial emergency because of COVID-19, worried about foreclosure, looking to pursue debt consolidation, or simply need to access extra cash but have bad credit - a home equity loan may be able to help you in your situation. RefinancingLiving on Vancouver Island or in the Lower Mainland, and looking to replace your current mortgage loan with a new one? You might be able to qualify for a home equity loan that’s higher than your current loan balance. We work with you one-on-one to understand your personal financial and homeowner situation in order to help you evaluate your best options when looking to refinance. We base your loan approval on your available home equity, not your income or your credit like traditional banks. If you’re unsure of your available home equity and live in BC, use our home equity loan calculator or get in touch with us to discuss your options today with a free, no-obligation consultation. Contact Jim Horvath today at 604.620.2697 for a friendly conversation.

|

Silver Hill BlogJim Horvath is the principal broker and director of Silver Hill Mortgage Corp., arranging private mortgage loans in British Columbia for over 25 years. Archives

March 2024

Categories |

|

Silver Hill Mortgage Corp. Head Office

2902 West Broadway | Suite #302 Vancouver, BC, Canada V6K 2G8 E: info@yourequityloan.ca P: 604.620.2697 F: 855.299.5832 (Toll Free) |

Stay in Touch |

About UsSilver Hill Mortgage Corp. is a trusted industry leader in delivering home equity loans and other private mortgage financing solutions for homeowners and bank declined customers in British Columbia. Get in touch to get approved today.

Copyright © 2024 Silver Hill Mortgage Corp. All rights reserved. |

Proudly serving our BC communities:

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

Vancouver Private Mortgage | Surrey Private Mortgage | Burnaby Private Mortgage | Richmond Private Mortgage | Abbotsford Private Mortgage | Kelowna Private Mortgage | Nanaimo Private Mortgage | Victoria Private Mortgage | White Rock Private Mortgage | Coquitlam Private Mortgage | Langley Private Mortgage

RSS Feed

RSS Feed